Little Known Facts About Paul B Insurance.

Wiki Article

Paul B Insurance - The Facts

Table of ContentsAn Unbiased View of Paul B InsuranceWhat Does Paul B Insurance Do?The Only Guide for Paul B Insurance7 Simple Techniques For Paul B InsuranceThe Facts About Paul B Insurance RevealedHow Paul B Insurance can Save You Time, Stress, and Money.

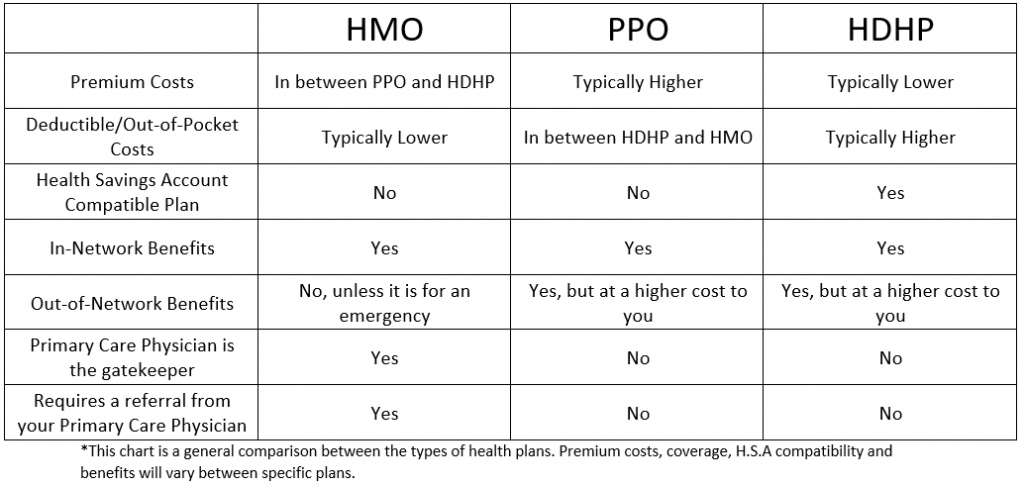

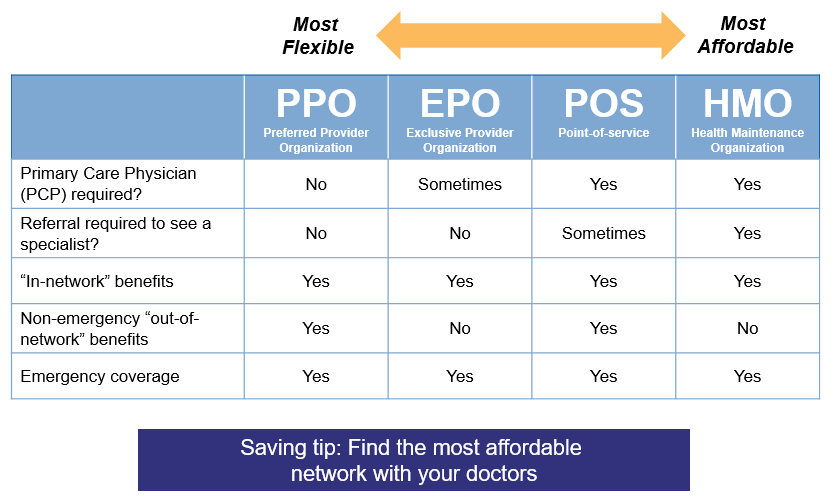

Relevant Subjects One reason insurance policy concerns can be so confounding is that the medical care market is regularly transforming as well as the coverage plans provided by insurance providers are tough to categorize. Simply put, the lines between HMOs, PPOs, POSs and various other sorts of coverage are usually blurry. Still, comprehending the make-up of different strategy kinds will certainly be valuable in assessing your alternatives.

As soon as the deductible amount is reached, additional health and wellness expenses are covered based on the arrangements of the medical insurance policy. An employee could after that be accountable for 10% of the costs for care gotten from a PPO network supplier. Deposits made to an HSA are tax-free to the company and also employee, and money not spent at the end of the year may be rolled over to pay for future medical costs.

The 7-Minute Rule for Paul B Insurance

(Company payments must coincide for all workers.) Workers would certainly be liable for the first $5,000 in medical expenses, but they would each have $3,000 in their individual HSA to pay for clinical expenses (and also would certainly have a lot more if they, as well, added to the HSA). If employees or their family members exhaust their $3,000 HSA allocation, they would pay the following $2,000 expense, whereupon the insurance plan would begin to pay.(Particular restrictions may put on very compensated participants.) An HRA has to be funded solely by a company. There is no limitation on the amount of money an employer can add to employee accounts, however, the accounts might not be funded via staff member income deferrals under a snack bar plan. In addition, companies are not permitted to reimburse any type of component of the balance to staff members.

Do you know when the most wonderful time of the year is? The wonderful time of year when you obtain to compare health and wellness insurance policy prepares to see which one is right for you! Okay, you got us.

Fascination About Paul B Insurance

When it's time to pick, it's crucial to recognize what each strategy covers, exactly how much it sets you back, as well as where you can use it? This things can really feel difficult, yet it's easier than it appears. We created some sensible learning actions to aid you feel great about your options.Emergency treatment is commonly the exception to the regulation. Pro: Many PPOs have a good selection of providers to pick from in your area.

Con: Higher costs make PPOs much more pricey than various other types of strategies like HMOs. A health and wellness maintenance company is a medical insurance strategy that normally only covers treatment from doctors that benefit (or agreement with) that specific strategy.3 So unless there's an emergency situation, your plan will certainly not spend for out-of-network treatment.

How Paul B Insurance can Save You Time, Stress, and Money.

Even More like Michael Phelps. The strategies are tiered according to how much they cost as well as what they cover: Bronze, Silver, Gold and also Platinum. (Okay, it holds true: The Cre did have some platinum records and Michael Phelps never ever won a platinum medal at the Olympics.) Trick fact: If you're eligible for "cost-sharing reductions" under the Affordable Care Act, you need to select a Silver strategy or better to get those reductions.4 It's good to recognize that strategies in every category offer some sorts of cost-free preventive care, and some offer complimentary or reduced healthcare solutions before you fulfill your deductible.Bronze plans have the least expensive month-to-month costs yet the highest possible out-of-pocket expenses. As you work your method up through the Silver, Gold as well as Platinum classifications, you pay much more in premiums, but much less in deductibles and also coinsurance. However as we pointed out previously, the additional costs in the Silver category can be minimized if you get approved for the cost-sharing reductions.

Paul B Insurance for Dummies

When choosing your medical insurance strategy, don't ignore healthcare cost-sharing programs. These work practically like the other health insurance programs we explained already, however practically they're not a type of insurance policy. Enable us to explain. Health cost-sharing programs still have regular monthly premiums you pay as well as defined protection terms.

If you're attempting the do it yourself path and have any type of sticking around concerns concerning medical insurance strategies, the specialists are the ones to ask. And they'll do more than simply address your questionsthey'll also find you the finest cost! Or perhaps you would certainly such as a method to integrate obtaining great medical care insurance coverage with the chance to help others in a time of demand.

The Greatest Guide To Paul B Insurance

Our relied on partner Christian Healthcare Ministries (CHM) can assist you figure out your options. CHM aids families share healthcare expenses like clinical tests, maternal, hospitalization and also surgical treatment. Hundreds of people in all 50 states have made use of CHM to cover their medical care needs. And also, they're a Ramsey, Relied on companion, so you recognize they'll cover the clinical costs they're expected to as well as recognize your coverage.Secret Concern 2 One of the important things healthcare reform has performed in the U.S. (under the Affordable Care Act) is to present more standardization to insurance coverage plan advantages. Before such standardization, the benefits used Click Here different drastically from plan to strategy. Some plans covered prescriptions, others did not.

Report this wiki page